What is a guarantor loan?

How to get one and why you should

Saving that initial first deposit is often described as the hardest part of getting into the market.

There is nothing worse than scrimping every dollar all the while house prices are skyrocketing and you know you are missing out on potential capital growth.

But, there is a way that could save you thousands of dollars on your deposit and get you onto the property market sooner.

If you have a family member with equity in property, they may be able to help you with your deposit and purchase costs, this is called a guarentor loan.

How it works:

You borrow 100% of the purchase price, including purchase costs

80% is secured by your new property

20% plus purchase costs is secured by your guarantor’s property

The best part is that because the amount you’ve borrowed is less than the combined value of the two homes, you don’t have to pay expensive Lenders Mortgage Insurance (LMI).

My parents dont have equity in their home. Can they still help out? The bank of mum and dad.

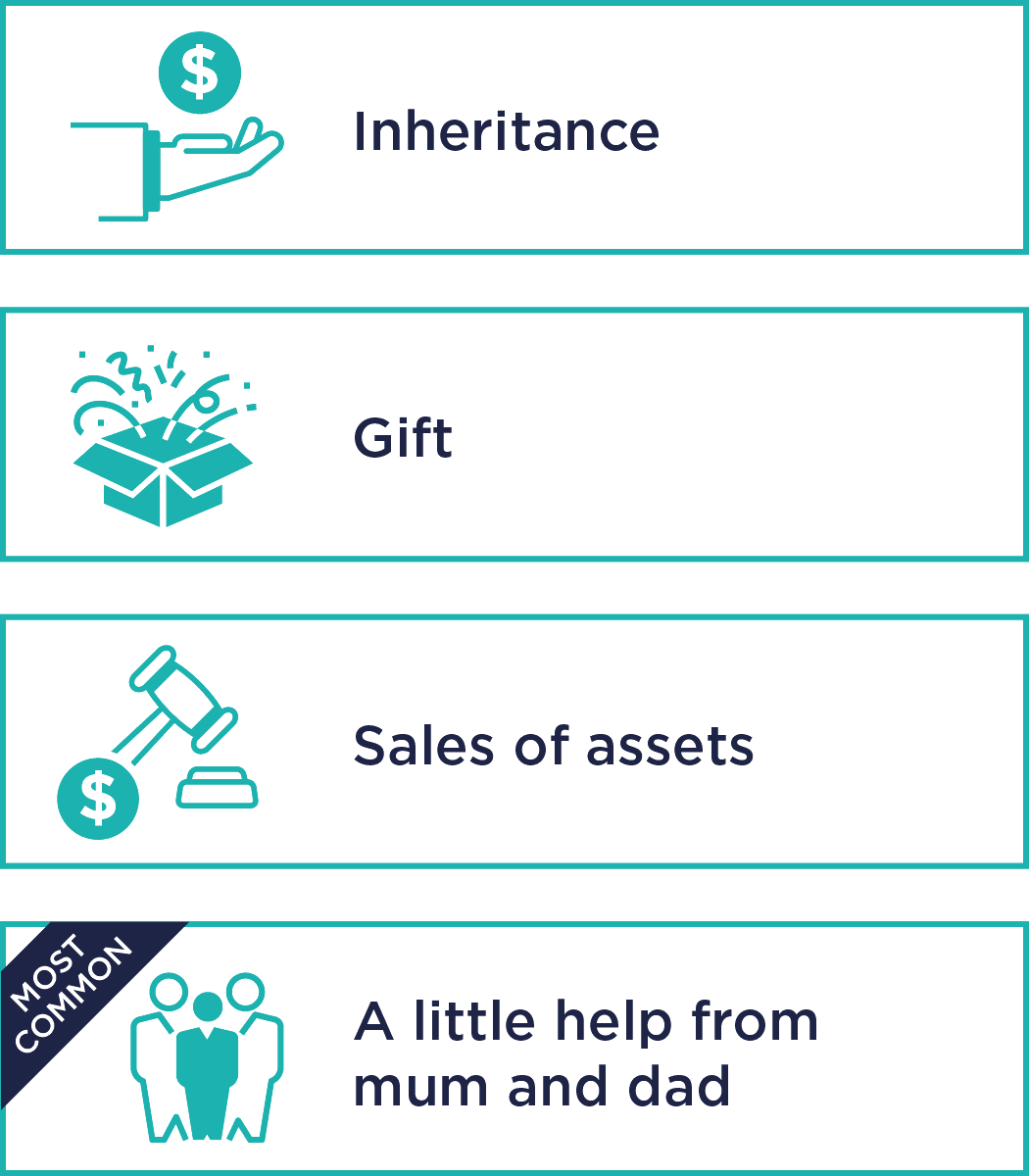

You may have different circumstances in which you’ve come into money quickly rather than ‘hard yard’ savings.

These are the non-genuine savings that are perfectly acceptable:

To help make home ownership more accessible to first homebuyers, many are turning to their families for financial assistance. There are many benefits to be gained, we recommend scheduling an appointment with a Mynt Broker with both your parents and yourself to get started and we can discuss your options.