With Melbourne property prices continuing to rise, many buyers are stuck between two choices:

Should I buy where I can afford, or rent where I want to live?

This question is leading more Aussies, especially first home buyers – to explore a strategy called rentvesting. It’s becoming one of the smartest ways to get a foot on the property ladder without giving up lifestyle or location.

So, what exactly is rentvesting and is it right for you?

🔄 What Is Rentvesting?

Rentvesting is when you buy an investment property in an affordable area, and continue renting in a location you love (often closer to work, family, or the city).

It flips the traditional idea that your first property must be your dream home. Instead, you start building wealth through real estate, even if you’re not living in it.

✅ Pros of Rentvesting

Get into the market sooner: You can buy where it’s affordable now rather than waiting to save a bigger deposit for your ideal suburb.

Potential tax benefits: As an investor, you may be eligible to claim expenses like interest and depreciation.

Lifestyle flexibility: Keep renting in a vibrant suburb you love, close to cafes, work, or public transport – without the mortgage that comes with it.

Grow equity faster: You might see better capital growth or rental yields in areas with more upside.

⚠️ Cons of Rentvesting

You’re not living in your property: Emotional connection is lower, and you’ll still be paying rent where you live.

Two sets of costs: Rent + mortgage can feel like a lot. You’ll need to budget wisely.

Not all tax benefits apply forever: Depending on future changes or if you move into the property later, tax implications may shift.

You may miss homeowner grants: Some government incentives are for owner-occupiers only.

🏘️ Melbourne: Where You Can vs. Can’t Afford to Buy

Melbourne’s property market is diverse—and affordability varies wildly between suburbs.

Example:

| Suburb | Median Price (2025) | Buy or Rent? |

|---|---|---|

| Elwood | $1.3M+ | Often out of reach to buy first, but popular to rent |

| Brunswick | $1.05M | Buying is tricky without a large deposit |

| Sunshine | ~$680K | Emerging growth suburb, more affordable for first-time buyers |

| Geelong | ~$660K | Popular rentvest option with solid growth |

| Ballarat | ~$550K | Affordable entry point, rising rental demand |

🔎 Source: CoreLogic & Domain data, 2025 estimates

👥 Real Client Example

“We always thought we’d have to leave Melbourne to buy,” said Talia and Daniel, a couple renting in Elwood.

“But after chatting with the team at Mynt Financial, we realised we could afford a great investment property in Ballarat. We’re building equity while still enjoying the lifestyle we love. Rentvesting was the best decision we made.”

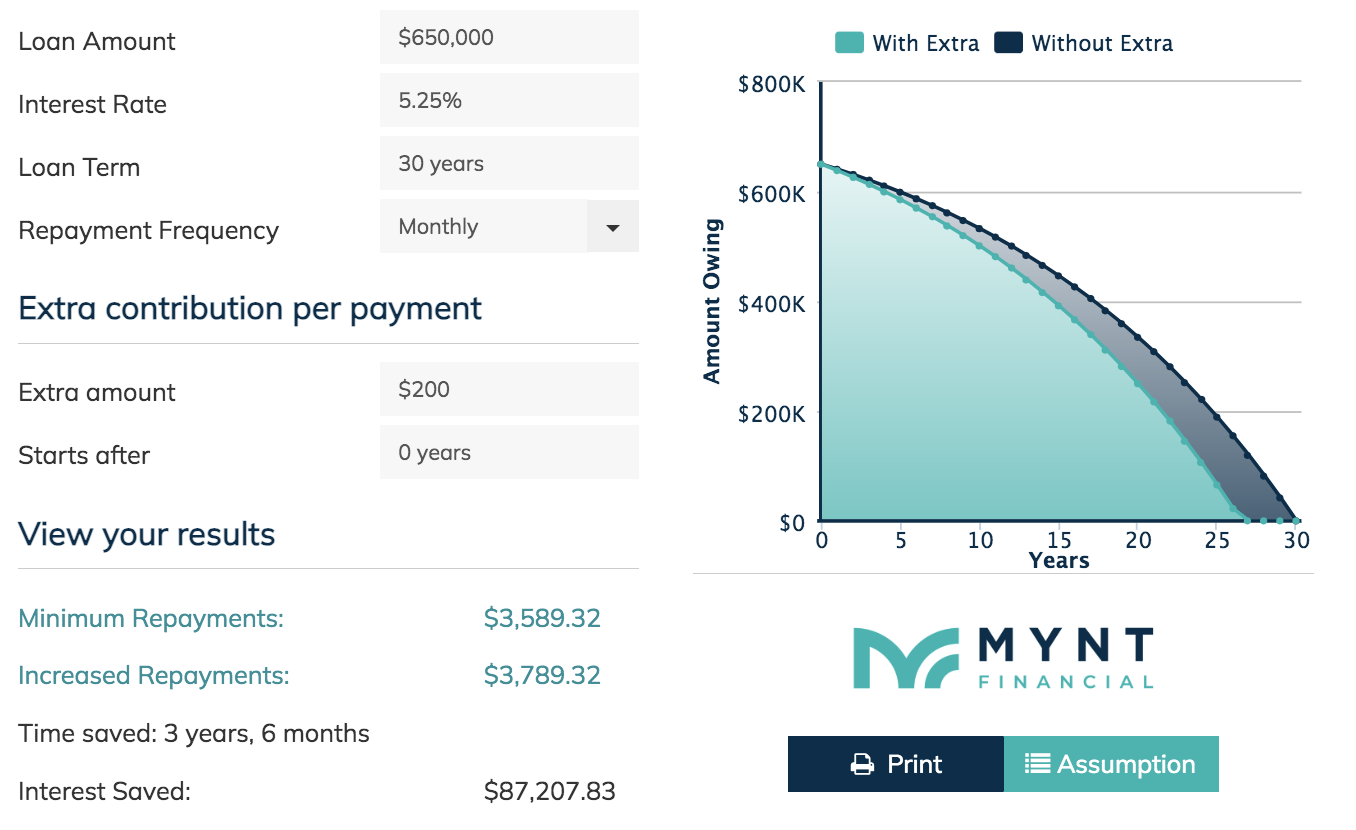

🧮 Want to Crunch the Numbers?

To help you compare your options, we’ve created a Rentvesting vs Buying Calculator:

🤔 Curious Which Strategy Suits You?

Everyone’s situation is different. Whether you’re dreaming of inner-city life or want to maximise your investment potential, we’re here to help you work it out.

👇

Book a free, no-obligation chat with one of our Lending Specialists. We’ll walk you through your options, run the numbers, and help you create a plan that fits your goals.