Financial stress can significantly impact the health, morale, and productivity of Australian workers, unfortunately, it’s common in the workplace. Over one in four Australian workers express low confidence in their financial position and struggle to make ends meet.

From an employer’s perspective, financial stress can hamper workplace performance and overall productivity. Financially stressed employees are less engaged and twice as likely to use work time to address personal financial issues.

When employees have clear financial goals, such as saving for a home, managing debt, or investing, they tend to be more focused and motivated in their daily lives. Some may need assistance in creating a plan.

While many companies invest in employee health and mental well-being, providing financial education can also yield significant benefits.

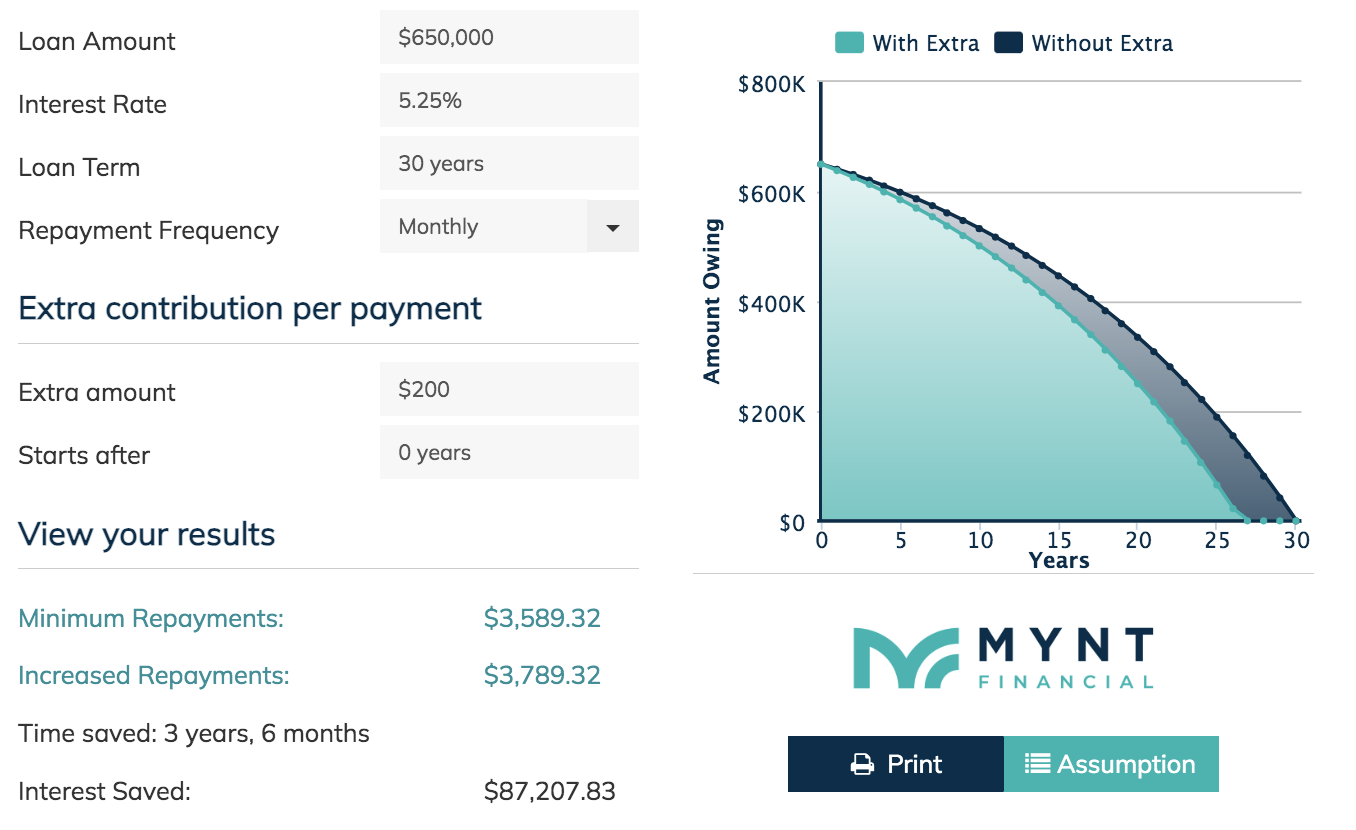

Mynt Financial is passionate about financial well-being. Our workplace lunch and learn sessions or Wellness Wednesdays could be a valuable additions to your organisation’s efforts to help employees manage their finances better. Whether it’s about borrowing capacity, buying property, debt consolidation, or mortgage repayment strategies, let’s work together to set financial goals and achieve them.

Some of the Topics we cover:

- Ways to pay off your mortgage quicker /home loan structures

- Refinancing – is it really worth it & what to look for?

- Saving for your first home – what deposit do you need / How much can/should you borrow?

- Consolidating Debt – Personal loans/Credit Cards / car loans

- Creating a budget to get in front

- Buying an investment property – what’s involved?

- Buying a house with partner/friend or family member

- What’s your credit Score – impacts and how to improve

- Budgeting tools/apps to help improve your spending/savings

If you would like to discuss having Mynt Financial run some ‘Financial Wellness’ sessions in your workplace, Reach out to Kristy@myntfinancial.com.au