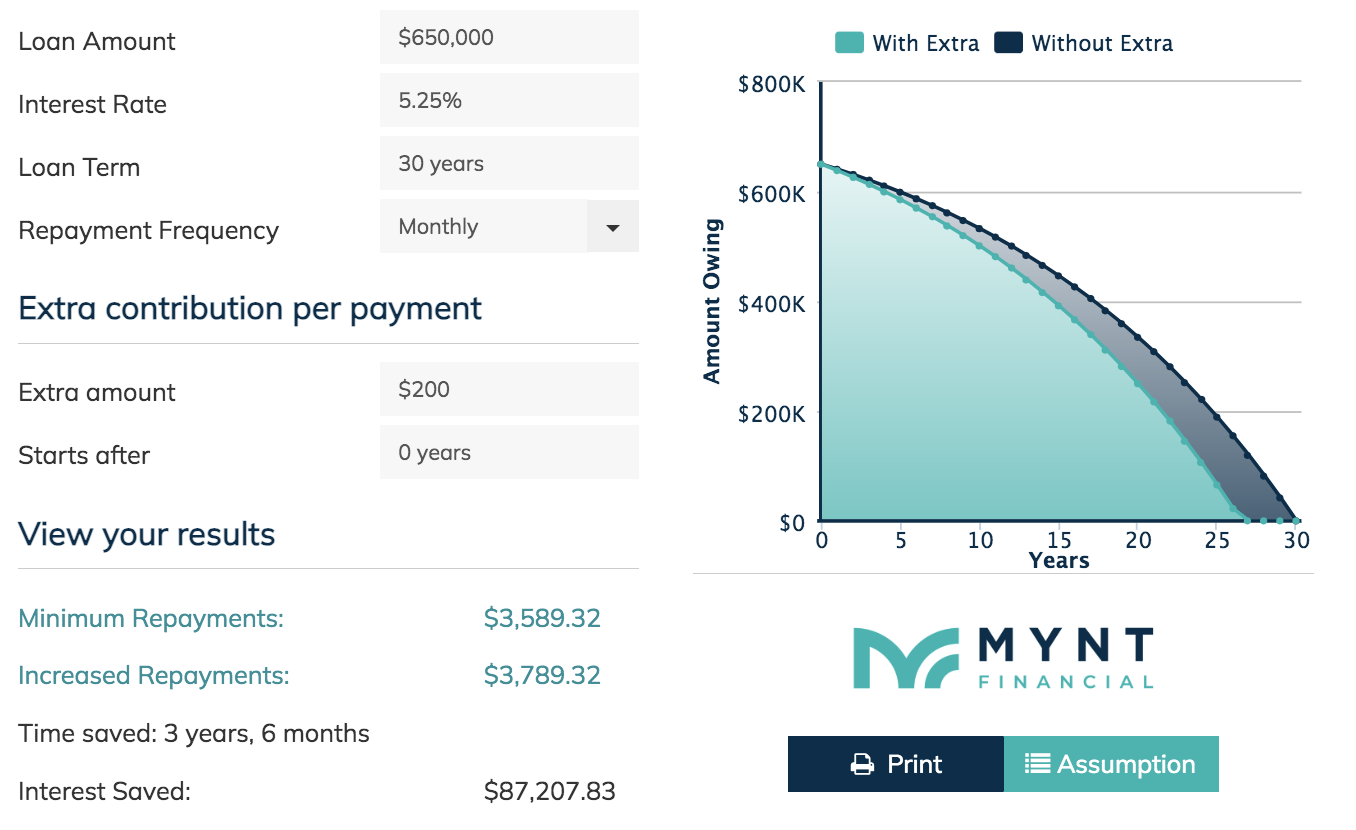

- Regular repayment: around $3,589 per month.

- Add just $50 a week extra ($200/month).

Over the life of the loan, that extra coffee-money habit could:

Over the life of the loan, that extra coffee-money habit could:- Save you around $87,000 in interest, and

- Cut your loan term by about 3.5 years.

That’s 3.5 fewer years of mortgage stress and 3.5 extra years of enjoying your income in retirement.

$50 a week is about 7 takeaway coffees. Swap the daily barista run for a couple of homemade brews and suddenly you’re years ahead financially.

Most Australians take 25–30 years to pay off their home loan, with the average homeowner not mortgage-free until their late 50s or early 60s. Imagine if you could shave off just a few years: that’s more freedom, more travel, and more money to enjoy when you’re still young enough to make the most of it.

- When do you want to be mortgage-free?

- Are you with the right lender to make that happen?

- What’s your end game and are you on track?

Everyone’s strategy is different, and this won’t be the right move for everyone. But if owning your home outright and planning for retirement is important to you, then why not start with this small, simple step today?

Director Mynt Financial

If you would love to chat about your home loan options – Reach out for a quick chat today