If you haven’t checked your current interest rate or compared it to other lenders in the past 12 months, you could be paying thousands more in interest than necessary. A lower rate doesn’t just mean less interest paid over the life of your loan—it also means lower monthly repayments, putting more money back in your pocket.

How We Just Helped Simone Save Big

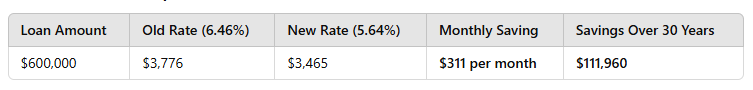

Simone X came to Mynt Financial wondering if he could get a better deal. He was on a 6.46% interest rate, and after reviewing his options, we refinanced him to a 5.64% variable rate.

That’s over $100K saved in interest over the life of the loan, just by switching to a better deal!

Thinking of Refinancing? Here’s How It Works

✔ Step 1 – Book a quick chat with Mynt Financial

Let’s review your current home loan and see if you’re on the best rate possible.

✔ Step 2 – We check if your lender can offer you a better deal

Sometimes, we can negotiate a lower rate with your existing bank, saving you the hassle of switching.

✔ Step 3 – Compare with other lenders

If your lender won’t budge, we compare offers across 40+ banks and lenders to find you the most competitive deal.

Bonus Tip:

Your home’s value may have increased over the past year. If so, this could reduce your Loan-to-Value Ratio (LVR), which might qualify you for even lower interest rates. We can order a valuation to see if this works in your favour.

Why Pay More Than You Should?

Refinancing could save you thousands, and it costs nothing to find out. Let Mynt Financial do all the hard work, from rate comparisons to lender negotiations.

📞 Book a free 15-minute chat today, you’ve got nothing to lose and big savings to gain!

______________________________________________________________________________________________________

Disclaimer: Whilst every care has been taken to ensure the accuracy of the numbers and details in this article, they are provided as examples only. Loan rates, repayments, and savings will vary based on individual circumstances. Please speak to a qualified mortgage broker to receive personalised advice tailored to your financial situation.